HPL Electric & Power Limited IPO @ Rs. 175-202 – Subscribe or Not?

Despite being a big issue, ICICI Prudential Life IPO sailed through quite comfortably yesterday. Post this IPO, ICICI Bank has been able to successfully raise Rs. 6,057 crore from its stake sale in ICICI Pru Life. Not only it got subscribed comfortably, the issue got oversubscription to the tune of 10.48 times its issue size. That is […]

Best Price to Buy iPhone 7 or 7 Plus in India

Apple launched iPhone 7 in the US on September 7 for a starting price of $649 and iPhone 7 Plus for $749. Despite being an expensive phone, it got an unprecedented response and went missing from the stores very quickly. Apple share price also soared from $107.70 on September 6 to $115.57 on September 15. […]

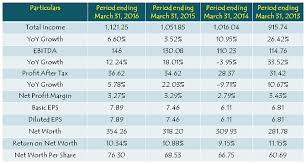

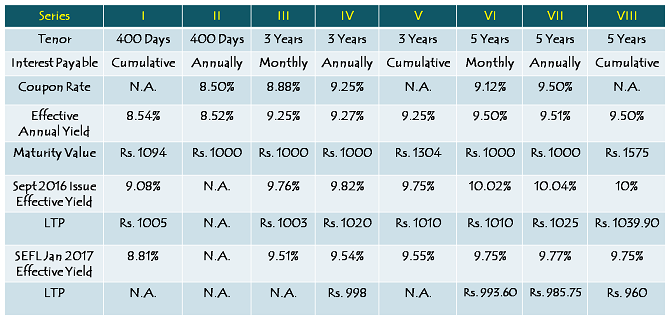

SREI Infrastructure Finance 9.50% Non-Convertible Debentures (NCDs) – January 2017 Issue

Falling interest rates on bank FDs has resulted in investors hunting for higher yield fixed income options, which in turn has prompted private NBFCs to launch a slew of NCD issues in the last 4-5 months. DHFL, Indiabulls Housing Finance, Reliance Home Finance, SREI Equipment Finance and Muthoot Finance, all have been successful in raising […]