What are NRI Bonds?

The Rupee has fallen significantly this year, and with Friday’s Current Account Deficit data release – it tumbled to a new low of 72.63 to a dollar today.

There are reports of the government thinking about issuing NRI bonds to help with this depreciation and it seems like the government will be forced into action soon.

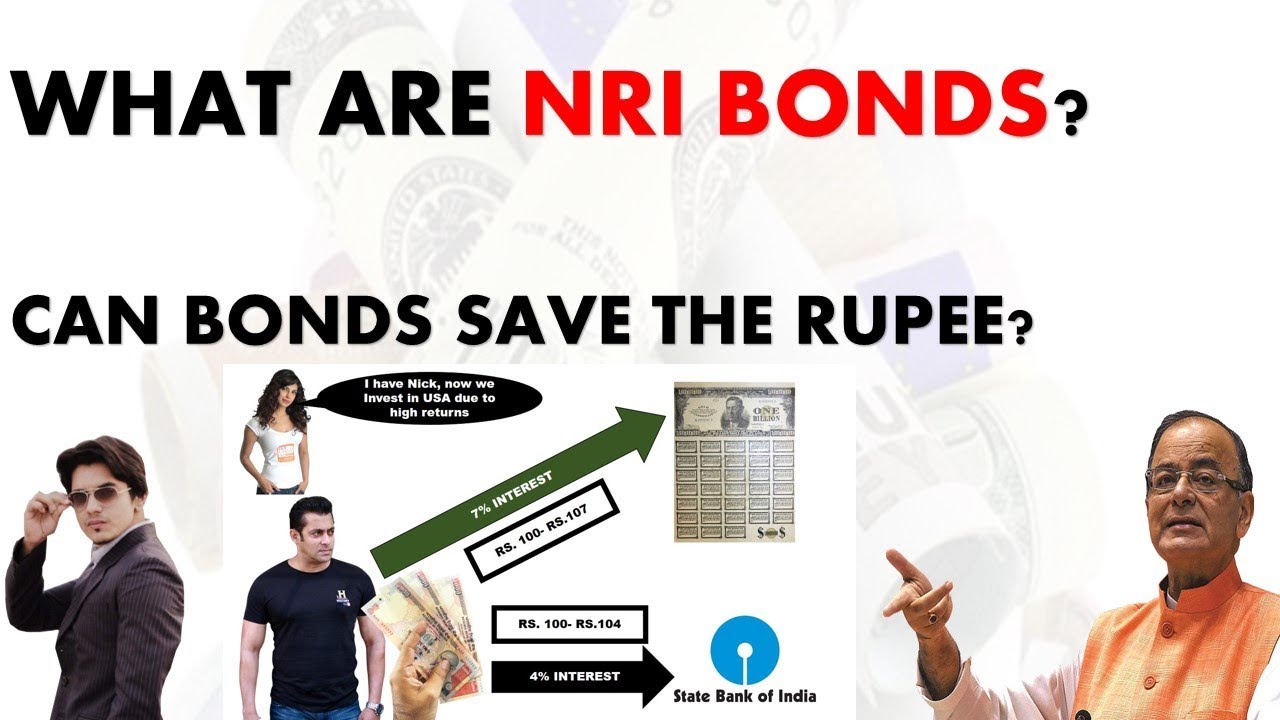

While there aren’t any details available on how NRI bonds will be issued (if at all they are issued) – from previous times we know that the branches of Indian banks outside India will allow NRIs to deposit their dollars, which can then be transferred to the Indian branches thereby helping with the Rupee slide.

For their trouble – NRIs will get a better interest rate than their domestic banks, and usually an ability to convert their Dollars into Rupees back home. There will likely be a lock in period of 3 – 5 years in the scheme, and history is any indicator it will very likely bring in good inflows from NRIs because the RBI was able to raise $30 billion from a similar NRI bond scheme in 2013.